Trade Secrets & IP

Employees present the business owner with an interesting dilemma. They are one of the greatest assets of any business and at the same time they pose one of the greatest risks of loss of company value.

Employees can pose a serious threat to the business due to the loss of trade secrets and other intellectual property.

Companies should have robust confidentiality agreements that their employees are required to sign, and they should actively identify and protect trade secrets and other intellectual property that the business owns.

If a business employs engineers and developers to write code, it is important that the exclusive ownership of that code be with the company.

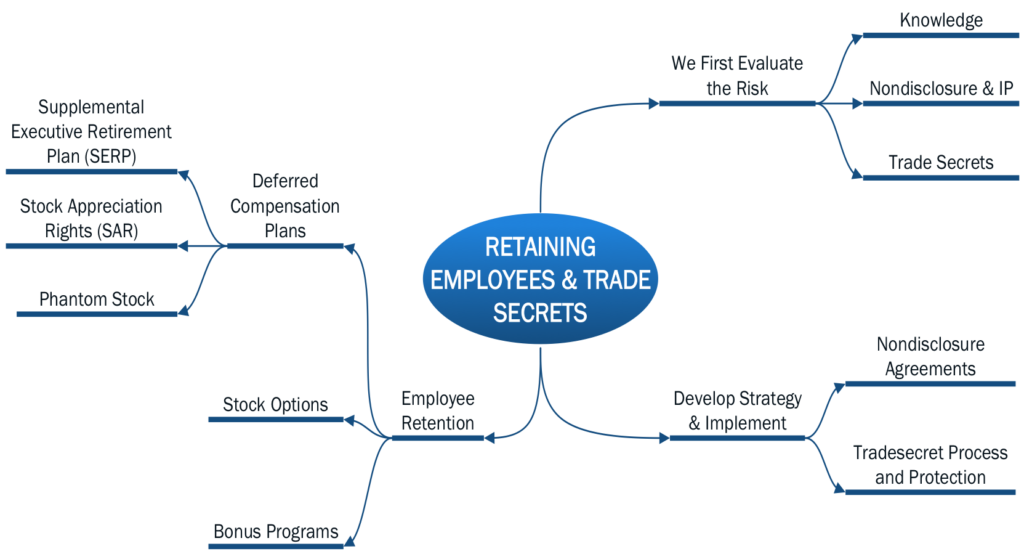

We work with business owners to sort through all of these issues and build an IP strategy.

We help companies evaluate the risks associated with the loss of key employees and develop appropriate employee retention programs. These include deferred compensation plans, stock options, and bonus programs that protect against those risks.

Retaining Key Employees

The lifeblood of most companies are their employees, and these employees often account for a substantial portion of the company value. As a whole, a trained workforce enables a company to provide the products and resources it sells. Excessive turnover can be a silent killer of profits, and losing key employees can significantly impact the value of a business. That is one of the reasons retaining key employees becomes essential for most businesses.

One of the primary methods of retaining key employees is through Deferred Compensation programs. Employees often don’t feel part of the success of the business. When their efforts produce extraordinary results, they often don’t get significant benefits. Business owners, on the other hand, while wanting to reward their star employees, often don’t want or are ill advised to allow employees in as equity owners of the company.

Deferred compensation plans often fit the needs of both the business owner and the employee perfectly. Phantom Stock, Stock Appreciation Rights, and Supplemental Executive Retirement Plans provide a piece of the upside growth without giving away voting or other minority shareholder rights, and with delayed vesting and forfeiture provisions on termination of employment they can be crafted to provide major incentives for employee retention.