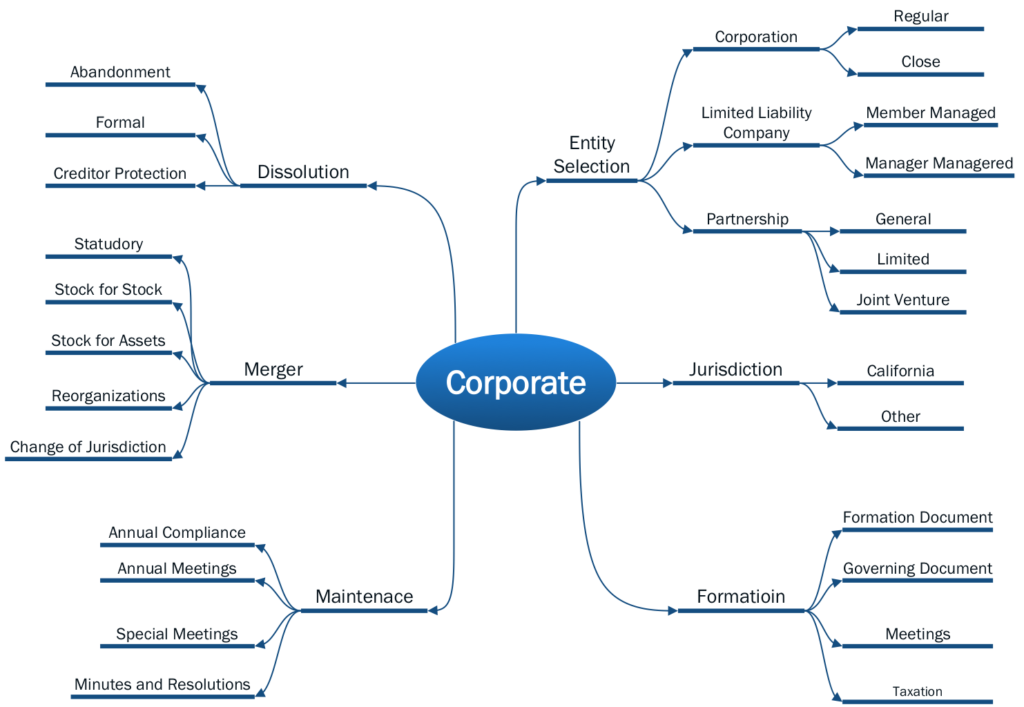

One of the first decisions a new business must make is the form of entity that will be used.

We help business owners choose between sole proprietorships, partnerships, corporations and limited liability companies for the operation of their business.

Some of the decisions that go into the entity selection process are:

- Will there be more than one class of stock?

- Will there be voting and non-voting stock?

- How will the entity be taxed?

- Are there reasons to not disclose whom the owners or managers of the business are?

Where the entity is formed is also quite important and there are 50 choices. California’s laws are not always business-friendly and we often recommend setting up an entity in another jurisdiction and then registering it to do business in California.

Entity formation has one additional aspect that is often overlooked. If there are multiple owners, it is important that the bylaws, operating agreements or partnership agreements be crafted to reflect the way the business owners intend the business to operate. This should include an agreement on how ownership and management will change if an owner leaves for any reason, including death.

We make sure that all these important issues are addressed in the package of formation documents.

We help match the needs of the business owners with a business formation and a jurisdiction that will provide the best fit and protections.

Business Entity Formation & Services:

- Corporation

- Regular

- Close

- Limited Liability Company

- Member Managed

- Manager Managed

- Partnership

- General Partnership

- Limited Partnership

- Joint Venture

- Jurisdiction / State

- Formation

- Maintenance

- Merger

- Dissolution